Kouga Municipality (KM) yesterday (29 May) released its 2025/2026 budget yesterday with mixed reactions – from praise to criticism and concerns.

While the mayor, Hattingh Bornman, and his followers lauded the achievements, commentators on local Kouga groups, locals in communities, posted negative comments illustrating the huge divide among residents and ratepayers in Kouga currently

The mayor said this budget is “a demonstration of how far we’ve come and how bold our ambitions have grown. This budget is a declaration of intent. It is a roadmap to a future where our communities are stronger, our infrastructure more resilient, and our services more responsive.”

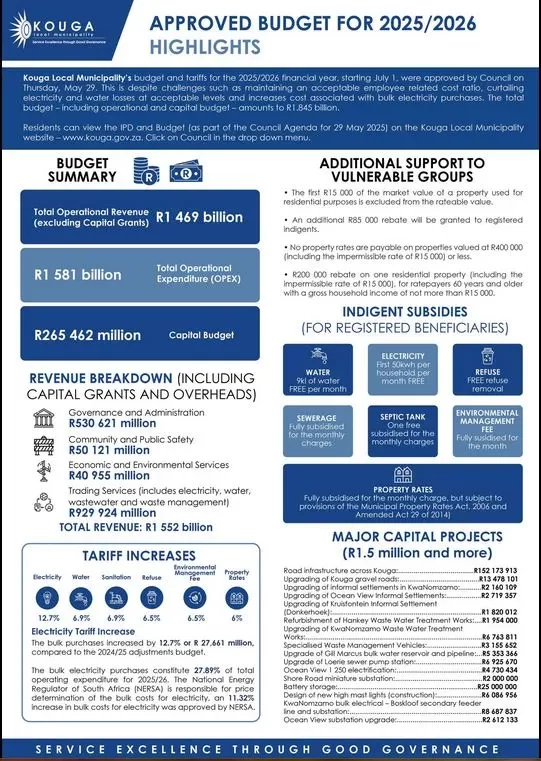

The budget (see attached poster, above, with bullet points that were posted on FB groups by the KM for the public) has also been commented on by some financial analysts already. They point out the financial allocations present strengths and potential risks.

Kouga Council’s new budget projects total operational revenue of R1.469 billion (excluding capital grants) against operational expenditure of R1.581 billion, with a capital budget of R265.462-m. The total revenue, including capital grants, stands at R1.552 billion.

The budget allocates R153.779-m for road infrastructure upgrades, including gravel roads in Kouga settlements, and R76.811-m for water and sanitation projects, such as new water treatment works. Trading services, encompassing electricity, water, wastewater, and waste management, account for R929.924 -m of the revenue breakdown, while governance and administration receive R530.621-m.

As for ‘indigent’ households, analysts note support for them includes 50 kWh of free electricity, 6 kl of free water, and one free sewer tank charge monthly, alongside property rate rebates for low-income residents and pensioners. Then the tariff increases, effective on 1 July this year, include a 12.72% rise in electricity (driven by an 11.32% increase in bulk costs), 6% for water, sanitation, and refuse, and 6.5% for property rates.

Analysts also highlight the fact that the budget reflects a deficit of R112-m for 2025/26 (a concern that was raised recently by some analysts in some local groups).

Predictions indicate deficits of R119.3 -m in 2026/27 and R86.8 -m in 2027/28, “even after accounting for capital,” they say.

Capital spending is set to decline sharply after this year, analysts reckon, dropping to R86-m in 2026/27 and R65-m in 2027/28. The employee-related costs, consuming 33.22% of the operating budget, exceed the 25–30% benchmark for efficient municipalities.

Analysts also highlight that a R200 -m loan from the Development Bank of South Africa (DBSA) for road rehabilitation, alongside R152 -m in borrowing for 2025/26, appears to lack a detailed repayment strategy in the budget documents.

Considering the budget’s transparency on service delivery backlogs, analysts note that while funds are allocated for water and sanitation, data on households, which lack access to basic services like water, sanitation, energy, and refuse, is still incomplete. “This makes it difficult to assess whether the most underserved areas are being prioritised.”

Positives and Negatives/Concerns highlighted by analysts:

Positives: The budget prioritises support for vulnerable groups, providing ‘indigent’ households with free electricity (50 kWh), water (6 kl), and sewer tank charges, alongside property rate rebates for low-income residents and pensioners. This aligns with South Africa’s basic service provision mandates. Capital investments of R265.462-m, including R153.779-m for roads and R76.811-m for water and sanitation, appear to address immediate infrastructure needs in Kouga, which is tourism dependent. (A link to the full budget document for public review has been given.)

Negatives/Concerns: A R112-m deficit in 2025/26, with projected deficits of R119.3-m in 2026/27 and R86.8-m in 2027/28, has raised concerns from analysts and local ratepayers about financial sustainability, potentially leading to reduced services or higher tariffs.

Analysts also say the 12.72% electricity tariff increase may disproportionately impact lower-income households and small businesses. Employee costs, at 33.22% of operating expenditure, exceed efficient benchmarks, suggesting a prioritisation of salaries over service delivery.

In addition, analysts fear the sharp decline in capital spending to R86-m in 2026/27 and R65-m in 2027/28 could hinder long-term infrastructure maintenance. Additionally, the absence of a repayment plan for a R200-m DBSA loan could increase financial risks, while apparent incomplete data on service delivery backlogs appear to obscure whether funds are reaching the most underserved communities.